How to invest in Lithium and REE.

C.S. We think that it is the right time to address different junior mining Exploration and Development companies engaged in Lithium and REE markets. After our

Gold Big Picture short term Sell warning and idea of rotation into junior mining sector in Gold and Silver, time is to check other opportunities in the market place. Do not take us wrong: Gold has a very long time to go, do not trade it if it is not your investment approach. We saw the signal - we share it, if we are correct consolidation could be in order and it will be the good time to accumulate Gold and Silver juniors, "

which represent even better value as an assets class" if Gold Bull market will be continued. It is Mr Gold Corp -

Rob McEwen and we are in a total agreement. While we will be waiting for catalyst (like Major buying out one of the Juniors, continued consolidation among juniors and investment public understanding that Gold will stay above 1000 USD/oz even after consolidation following the recent parabolic run) to propel junior gold and silver mining sector back to multiples close to summer 2008 for Oz of gold and silver in the ground, we will check on other pockets of growth with potential catalyst to unlock the value.

Gold came under pressure last Friday with a "very positive Job Numbers" and US Dollar rally, people started talking again about FED Rate Rise in the next year. We will not bet our farm on it and neither should you. First - you can never find any investment advise here and should not bet on anything, second - US Dollar has a structural problems and the only solution is to keep Green Fellow down. Job Report shows only one, but very important figure - if you are focused enough to destroy your currency value and print money you can postpone financial collapse if others are accepting the game rules (less and less) and financing you by buying your Debt with worthless paper just to keep you going. It means that we will have pockets of growth - there is always a bull market somewhere. We are preaching about ours.

Never let the others make decisions for you. Today we will discuss a few Lithium plays, some with REE flavour and will look at the charts: weather apart from fundamentals, Copenhagen, Warren Buffet and Jay Taylor we have something pointing to catalyst in this sector. We are looking for the start of Second stage of this Bull market.

We will concentrate on Canadian Stock Exchange and will take top five out of 19 mentioned in Lithium - Hype or Substance by Dundee Capital markets on October 28, 2009. All companies are above 10 mil market cap and we will not go below it. Out of six mentioned by Dundee Latin American Minerals will be excluded as they only have a 31% stake in a private company engaged in Lithium. The rest five are presented below with their charts by the market cap.

"Western Lithium Canada Corp. CAD 90 mil MC. WLC.v is focused on it Kings Valley hectorine project in Nevada. The deposit hosts a historic 11 million tonne lithium carbonate equivalent resource (estimated by Chevron in the 1980's) contained in five lences. WLC.v has an updated compliant resource on one of the lences. The Stage 1 (PCD) lens contains 1.3 million tonnes with grade of 0.27% Li (1.44% lithium carbonate). This near surface deposit is hosted by hectorine clay - hectorite clay deposits are not currently exploited on a commercial scale." Dundee. Below you can find Byron Capital price target of 3.5CAD. We note that Canaccord initiated it as well with a speculative buy and Price Target at 1.9CAD Very important notice is that nobody is producing from this type of deposits at the moment. This company is the largest in Lithium among Canadian juniors and Byron's coverage should move all sector if the company is credible enough in the eyes of investors. Technically we have a Cup and Handle bullish formation, all momentum indicators are neutral to positive, selling volume subsided in accumulation and any pick up could create a Buy signal. One project with a new type of deposit and rather low grade should give some concern after next run and consolidation, after it company should give more answers on its development. Recently announced and cancelled M&A deal shows that company is looking for direction, team behind it could give us a hint that they will try to be a consolidator in the sector. Who will be among their targets? We will leave it to your imagination.

"Canada Lithium Corp. 67 mil MC. CLQ.v primary focus is its past-producing Quebec Lithium Project. CLQ is also looking at other spodumene pegamatite deposits in Canada. (They canceled their option to obtain lithium brine project in Nevada after initial exploration - S.). CLQ.v has commenced a pre-feasibility study on Quebec Lithium and aiming for a completed feasibility study in 2010. CLQ.v suggested in March 2009 that it had materially advanced its lithium carbonate metallurgical process and could ultimately produce battery quality lithium carbonite. Quebec Lithium is located 60 km north of Val d'Or and produced for ten years in the 1950's and 60's. Spodumene rich dykes were extracted from the underground operation. A historic resource of 15.6 million tonnes with a grade of 1.14% Li2O remained following a ten year operation." Dundee. Canaccord has initiated coverage with a target Price of 0.5CAD. Technically stock chart could generate Buy near term, but company diluted itself at the very low levels and now is close to be fully priced at least by Canaccord estimations. Former CEO Judy Baker is not adding credibility to the team by her sudden departure and resurrection in

American Lithium, which as some suggested could be a heavily promoted company without any substance at all. After one month as a President there she is out again and is a "project manager". Check this one out carefully before any moves.

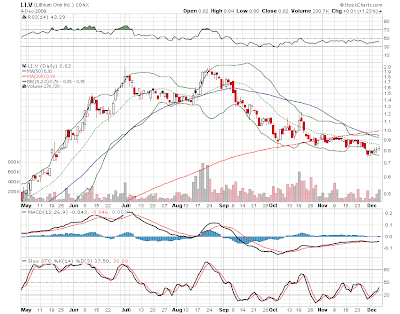

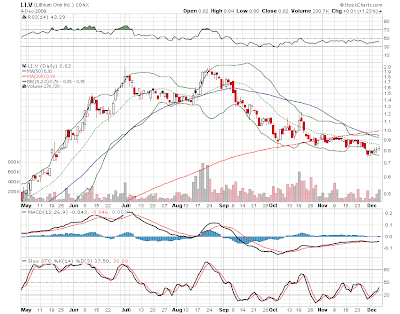

Lithium One Inc. 33 mil MC. LI.v's primary focus is the 1700 hectare James Bay project in northern Quebec. Several pegmatite dyke swarms have been identified by surface mapping. Drilling and trenching was undertaken in 2009 and most reported intercepts and channel samples have been in the 1.3% to 1.7% Li2O range. Company estimates that true widths of the dykes are up to 30 m wide. The company has also recently acquired over 25000 hectares of land in Argentina with surface brine samples containing high levels of lithium and potash (averaging of 640 ppm Li). Dundee. Canaccord initiated Lithium One with Target price of 1.2CAD On a chart side company looks like overshoot, with a double top and then lost more then 50% of its value from the peak. Nobody was buying it after the top and stock has slided where it is now. It means that insiders and people close to the company was not in a hurry to increase their positions. Company looks like a good combination of hard rock and brine lithium projects. Technical signal Buy could be generated with further buying pressure and there is room for appreciation at least to Canaccord TP of 1.2CAD.

"TNR Gold Corp. and International Lithium Corp. 25 mil MC. TNR Gold was an early mover in acquiring lithium properties and has assembled a package of eight properties that continues to grow. The projects are located in diverse geographical locations with pegmatites in Canada and Ireland and brine projects in Nevada and Argentina. TNR Gold plans a spin out of its lithium and rare earth element assets into International Lithium Corp. in the first quarter of 2010. The company will also be looking for joint venture partners to move their extensive property portfolio forward." Dundee.

Company is not followed by any investment houses with a Price Target at the moment, but was taken on its Watch list by Jay Taylor after San Francisco conference. Any coverage intiation will bring more attention to this junior.

"JAY'S WATCH LIST Nov 26, 2009

TNR Gold Corp. and wholly-owned

International lithium Corp. ("ILC") are demonstrating widespread and strong lithium, rare metals, and rare earth elements (lithium, tantalum, lanthanum, neodymium, and cesium) mineralization on its large portfolio of 16 projects worldwide spanning Argentina, Canada, USA Nevada, and Ireland. This is big news for ILC's spinoff in early 2010.

Also in play are TNR's key projects in Argentina: Eureka, El Salto, and El Tapau; and its Alaskan commitment: Shotgun and Iliamna. Shotgun hosts a million ounces of historic gold deposit, while Iliamna is an early-stage exploration project showing geological similarities to the nearby Pebble Deposit, approximately 50 km away. TNR will strengthen its assets through partnerships with mid-tier and major companies, and establish long-term cash flow through royalty interests and project development."

We will add from our side, that company was trading at the same level in Spring - Summer 2008 before any lithium and REE properties were acquired. It is an early stage exploration play and access to the capital will be critical for the company. Any significant result from the properties could generate a Buy signal from recent consolidation stage. Stock was in an accumulation stage around 0.3CAD recently and Insiders increased their position according to filing. It is the only company from this sector with drivers in lithium, REE, gold and copper with catalyst in the form of announced strategy to spin off International Lithium and Alaska Gold and Copper properties could follow this approach.

We own the shares of this company among others discussed on this blog, please do not take anything as a solicitation to buy or sell any particular stock on this blog.

"Rodinia Minerals Inc. 10 mil MC. RM.v flagship property, the Clayton valley property in Nevada, was acquired in February 2009. The project is located adjacent to the only lithium producing facility in the US, the Silver Peak brine operation (Chemetall-Foote Corp.), which currently produces 1.2 million kg of lithium per annum. Rodinia is the main land holder in the area. The company's second project, the Strider Lithium property in Manitoba, was acquired in May 2009." Dundee.

It is an early stage lithium brine exploration play in Nevada, U.S. Peter Grandich was engaged on promotion side by the company and stock jumped almost 20% forming a Double Bottom. Further upward pressure will confirm the Buy signal on technical side.

Toronto, ONTARIO -- (Marketwire) -- 12/03/09 -- Byron Capital Markets, a division of Byron Securities Limited, is pleased to announce that it has initiated coverage today on Western Lithium Canada Corporation (TSX VENTURE: WLC) with a Speculative Buy rating and a target price of $3.50.

In this 17-page research report, analyst Dr. Jon Hykawy gives a comprehensive overview of the company and speaks to the processes and economics of lithium production derived from hectorite clays.

This report further exemplifies Byron Capital Markets' continuing commitment to research and, in particular, its ongoing efforts in the Electric Metals space."

No comments:

Post a Comment