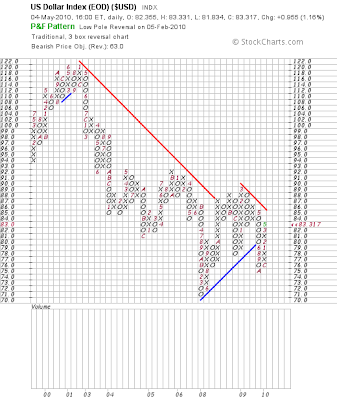

Everybody is scared by Greece and rightfully so, but do not miss the big picture with all worries about PIIGS and their health. PIIGS: Portugal, Italy, Ireland, Greece and Spain are on the front pages and everybody is buying Treasuries again, US Dollar has surged to the new highs and Euro has hit the 1.28 Our contrarian soul can not help, but to put a few charts for review. The main message is in the chart above: P&F is not the ultimate Crystal Ball, but works very good defining reversal in trends and recent trend for US Dollar was up. US Dollar destiny now is to be "less bad" - as Jim Puplava has put it. Austerity measures are not very popular as Greece has shown to the world today, US Corp. will not even dare to go there - the only other way out is to inflate your debts out. US Dollar destiny is to go down and Treasury Bubble is unfolding already from late 2008 as shown on the chart below. We have a lower highs and scared public is rushing to the "safety" of Treasuries exactly at the wrong time. And by the way Inflation is already here: China is tightening, Australia is hiking rates, Brazil, Norway...have you noticed - all Commodities and Growth related countries. The irony is that Greece is the prelude of what could come to the US shore: can you imagine to lose California? In Euro zone idea of its breaking up does not work exactly with the opposite reason to Euro move these days: take out PIIGS out and you will get the strongest Euro possible. Competition is now - who will debase its currency faster and everybody are in for orderly decline of US Dollar: Euro below 1.2 is a threat to stability and rising borrowing cost, above 1.5 makes export less competitive - the winner will be Gold, against which all currencies will depreciate. Second best will be commodity based Canadian and Australian dollars. Have you noticed that CAD was on parity with USD again? Canada talks about tightening and rate differentiation will put further pressure onto US Dollar. Financial system was tested with Lehman - it is insolvent, another run on the bank will break it beyond repair. Our take is that Greece will be bailed out, crisis contained and ECB has not even started QE, the fastest move could be to purchase sovereign debt from the banks to provide liquidity and support the prices. Wait until attention will be back to the homeland issues and mention the difference: Europe talks about Austerity, Cuts and Budget deficit before they start to print money by QE, U.S. use helicopters first and talks about deficit later. Regarding Swine Flu we will refer to our older post and will remind ourselves how many worries we had about unavoidable pandemic, which will spare only the Wall Street with inherited immunity. It finally strikes at unexpected location and Goldman Sachs is the first victim. Its omnipresence is understandable, they are doing the "God's job" after all...but who knew that they helped to cook the books even in Greece to get it the ticket into the Euro zone?

Treasury Bubble is still unfolding from late 2008, we have lower highs and recent PIIGS scare has brought more volume.

US Dollar is overbought, particularly after today's trading session, MACD shows lower highs with new highs - points to potential reversal to be confirmed.

Please notice that Gold recently was rising with US Dollar rising as well, Gold was rising against all currencies and it is a very important new development in the Gold bull market. Seasonality is against strong upside move in Gold, but after our signal Sell in December, Gold has perform reversal and has all technical strength to break to the new highs from Cup and Handle formation.

On a longer term chart we can tell that US Dollar is ready to produce Sell signal with counter move in Euro from oversold position with solid bail out news on Greece this week.

This is our Cup and Handle formation, which could propel Gold to the new highs: we have a Buy signal on MACD - the risk is to produce double top instead. Our wave count from recent inverted Head is the wave 5 up.

Political stupidity should not be underestimated, but we have a very good chances for US Dollar to resume its downward trend, helping fragile jobless recovery in U.S. Gold will make new highs in this case this year, another thing to worry will be price of Oil and Commodity prices in general - Jim Puplava talks about buying Electric Car and we better listen!

No comments:

Post a Comment