Peter Schiff separates truth from the mass media hype about Janet Yellen's real track record. As we have discussed before, her core beliefs are even more neo-keynesian than those of Ben Bernanke. The new play book for the FED is written by Michael Woodford and it will be even more fundamentally positive for the Gold. We can expect continuation of "pro-growth policies" with very little regard for the created bubbles along the way.

Peter was right about the Housing Bubble in 2006, he was right about the "Tapering" in September, what will happen if he is right again with his Call on Gold? We will provide his discussion on Gold and our entry on Michael Woodford to dig it out more for interested.

Peter was right about the Housing Bubble in 2006, he was right about the "Tapering" in September, what will happen if he is right again with his Call on Gold? We will provide his discussion on Gold and our entry on Michael Woodford to dig it out more for interested.

Gold Catalyst - John Williams: Very Serious Trouble in this Next Year - Weaker Dollar and Hyperinflation GLD, MUX, TNR.v, GDX

"John Williams is very respected economist who is providing the real economic data, which is not massaged by the government desires and wishful thinking. His view at the crucial juncture for US Economy and Health of US dollar us very important to share now.

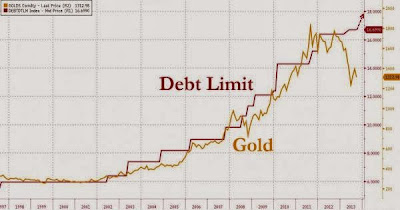

Gold celebrates today "The Deal" and it looks like that Debt Ceiling Raise Does Mean Increase in the Amount of debt after all."

Jim Rickards – Why China is Buying Gold & Calling for a De-Amercanized World GLD, MUX, TNR.v, GDX

Gold Catalyst: Chinese agency downgrades US credit rating GLD, MUX, TNR.v, GDX

"We have the downgrade of the US rating where it matters most: by the Buyers of US IOUs. S&P or Moody's will not dare to make the move as DOJ was very fast to remind S&P who is in charge, but Fitch this time was more following the real mess coming out of Washington, DC with its Negative Watch for US rating.

Now the desire of China to buy all available physical Gold can be put into perspective of long term state-level planning to diversify its currency reserves out of US Dollar based assets."

Peter Schiff: Debt Ceiling, Gold, and Janet Yellen - Hype vs. Reality GLD, MUX, TNR.v, GDX

"Peter Schiff gives us a great big-picture view on the latest developments in the markets and, particularly, ongoing Gold manipulation. Separating the Hype vs Reality he provides the explanations on the Janet Yellen's real track record and her intentions, describing the implications of her ascendancy to the FED Chair for the ongoing debasement of US Dollar and Gold."

Adam Hamilton: Cheap Gold Stocks- Opportunity of a Lifetime? GDX, MUX, TNR.v, GLD

"Adam Hamilton provides us with another set of observations for the fundamental and technical state of the market of gold mining equities. Fundamentals have never been better for Gold and increased Debt Ceiling does mean the increasing amount of debt and further debasement of US Dollar.

Very heavy manipulation in the Gold market is used in order to conceal the real situation with Gold available for delivery among LBMA banks and on the COMEX. As it has happened before, Gold investor's confidence is being killed just before major monetary expansion."

Flashback - Jim Puplava: Janet Yellen to the Chair And Michael Woodford Is The New FED's Play Book. GLD, GDX, MUX, TNR.v

It is time to repost our entry with Jim Puplava and find out the implications of the nomination of Janet Yellen to the FED. We can expect the Gold price to be under pressure to impose the false interpretation of extremely bullish fundamentals, but this manipulation will end with the real fireworks in this sector. Debt ceiling increase will happen after all this political posturing and new Chairperson will be even more accommodative in its polices based on Michael Woodford's narrative.

Jim Puplava: Janet Yellen to the Chair And Michael Woodford Is The New FED's Play Book. GLD, GDX, MUX, TNR.v

Bloomberg: Central bankers around the globe look to the economic theories of Michael Woodford for extraordinary methods to spur growth when interest rates are already near zero. Photograph: Ryan Pfluger/Bloomberg Markets

Jim Puplava is talking about "FED's Big Flip Flop" in his big picture this week. He is calling for Janet Yellen to be the next Chairperson of the FED. Her dovish monetary policy will be highly beneficial for our Gold Bull. Jim sees the transition from unemployment target to the GDP based target for the FED's monetary policy. Quite surprising in its honesty were two remarks from Bernanke: about unexpected tightening effect on the markets after FED's announcement about the tapering of QE - when interest rates have almost doubled from the spring low. And Ben's admission that unemployment rate does not provide the clear employment picture and is affected the employment participation rate.

Michael Woodford has become the new FED's play book after his monetary theories were widely adopted by the central banks around the world after Jackson Hole in August 2012. You can find his Bloomberg profile here.

Now we have more clues to understand why Eric Sprott is selling Art in order to buy more shares of Gold and Silver mining companies.

No comments:

Post a Comment